Summer Is Coming! How Hot? Find Out:

Staff Picks

Astronomy

The Next Full Moon Is The Flower Moon

Gardening

Weather

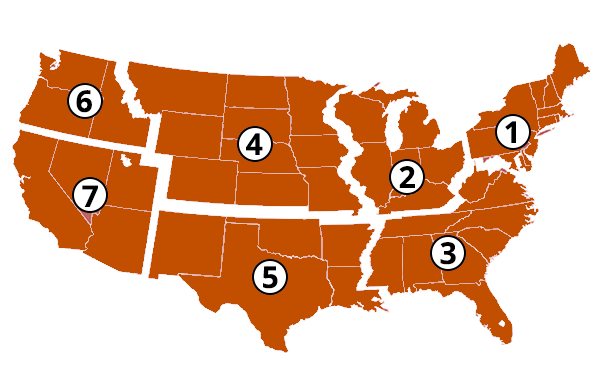

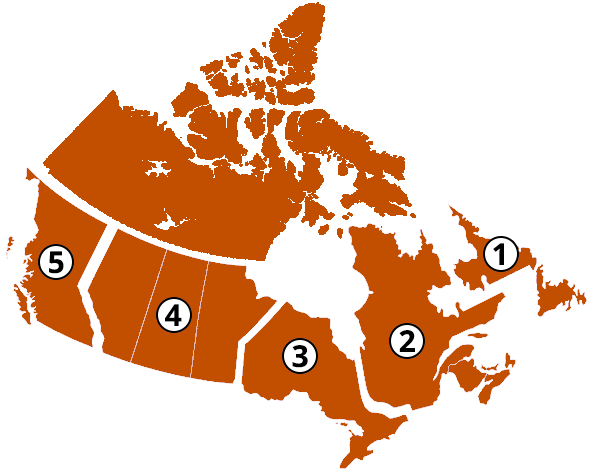

Long Range Weather Forecast

Click your zone below to see a detailed forecast in three-day increments

Weather History Search

Food And Recipes

Readers’ Favorites

Helpful Hints

Store Foods At The Right Temperatures

To ensure food safety, your refrigerator temperature should be 36-39 degrees Fahrenheit (approx. 4º C), and the freezer should be 0-6 degrees Fahrenheit (-18 to -14º C).